Private Health Insurance: Benefits Costs and Smart Tips

Private health insurance has become an essential choice for many individuals and families who want more control over their healthcare options.

Listen and keep following the latest news about insurance that we will discuss, which is only available on The Health Universe.

Understanding the Key Benefits

One of the biggest advantages of private health insurance is the ability to access medical services more quickly. Long waiting times can be avoided, allowing you to receive treatments, specialist appointments, and diagnostic tests without unnecessary delays.

Private insurance also gives you access to a wider range of hospitals, clinics, and medical professionals. You can choose your preferred doctor, customize your treatment options, and even access exclusive facilities not available under standard public healthcare.

Choosing the Right Plan

Start by assessing your personal health needs, such as chronic conditions, medication requirements, or the need for specialist care. This helps you narrow down which plans provide the most suitable coverage without paying for unnecessary extras.

Another smart tip is to review the insurer’s network and service quality. Check the list of hospitals, claim processes, customer support services, and reviews from other policyholders.

Read Also: ZO Skincare: Advanced Technology for Healthy Skin

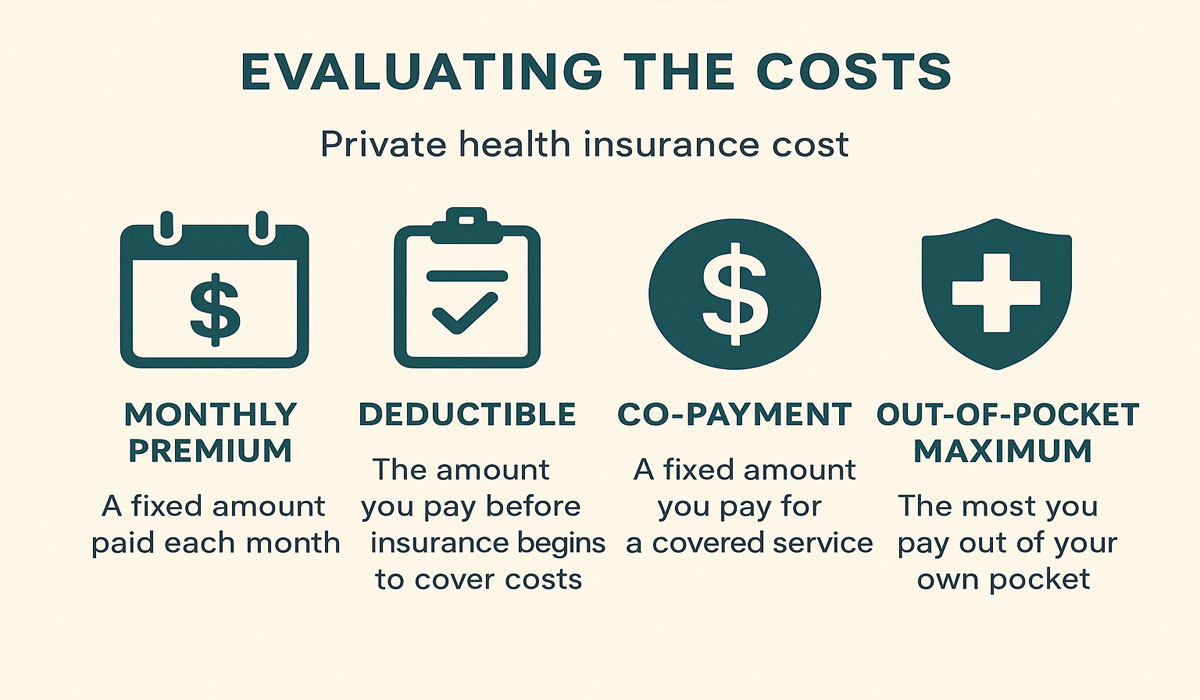

Evaluating the Costs

Private health insurance often includes several cost components such as monthly premiums, deductibles, co-payments, and out-of-pocket maximums. Understanding how each of these elements works is important because they significantly impact your total expenses over time.

It is also important to consider potential cost increases over the years. Premiums may rise due to age, medical inflation, or changes in policy coverage.

Review Your Policy Regularly

Health needs change over time, and your insurance plan should adapt accordingly. Reviewing your policy at least once a year ensures that your coverage still fits your lifestyle, financial situation, and personal requirements.

By updating your plan, you can avoid overpaying for coverage you no longer need while keeping essential benefits intact. This habit ensures long-term protection and helps you make better financial decisions as your situation evolves.

Conclusion

Private health insurance offers significant benefits, including faster medical access, greater provider choices, and flexible coverage options. By understanding the costs and applying smart selection strategies, you can maximize value and maintain strong health protection.

Don’t miss the latest and viral information that we will provide only on The Health Universe.

Image Information Source:

- First Image: itsmyhealthinsurance.com.au

- Second Image: sterwebe.info