How to Choose the Right Private Health Insurance for Your Family

Smart ways to choose private family health insurance, ensuring maximum protection, easy claims, and budget-friendly premiums.

Choosing private health insurance for your family isn’t just about finding the lowest premium. This decision is crucial because it will determine the financial protection and quality of healthcare for all family members when facing medical risks. Many people are confused by the wide range of insurance product options available, ranging from inpatient and outpatient benefits to additional facilities. Here The Health Universe, understanding how to choose the right private health insurance is a crucial step to ensuring maximum protection and wise family financial management.

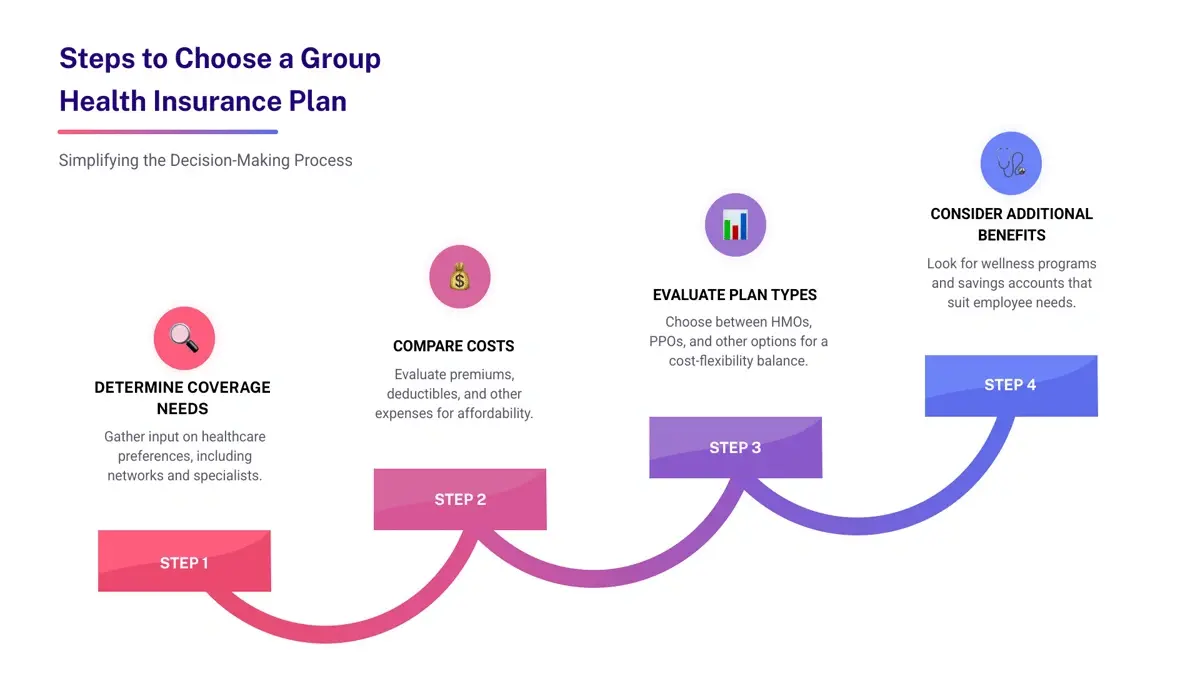

Understand Your Family’s Health Needs

The first step in choosing private health insurance is understanding the health needs of each family member. Every family has different circumstances, such as age, medical history, and frequency of doctor visits. For example, families with young children may need more coverage for children’s hospitalization and immunizations, while families with elderly members need to pay attention to the risk of chronic diseases.

Furthermore, understand the family’s lifestyle and potential health risks. Does your family travel frequently, engage in extreme sports, or live in an area with limited healthcare facilities? These factors will influence the type of policy you should choose.

Finally, note your priority medical needs, such as specialist care, medications, or specific therapies. Understanding these needs will help you focus your insurance selection process and avoid paying premiums for unused benefits.

Compare Policy Benefits and Coverage

After understanding your family’s needs, the next step is to compare the benefits and coverage offered by the policies. Not all private health insurance plans are created equal; even with similar premiums, the coverage and claim limits can vary significantly. Some policies offer comprehensive inpatient coverage, doctor consultations, prescription drugs, and even dental and eye care.

Furthermore, check the annual and lifetime coverage limits. A policy with a low annual limit may not be sufficient if your family faces a serious illness, while a high lifetime coverage limit provides more long-term security. It’s also important to check for additional benefits such as hospital reimbursement, telemedicine, or a wide network of partner hospitals.

Finally, carefully review policy exclusions. Many people overlook these and later encounter problems when making a claim. Ensure all important health conditions are covered and that potential risks arising from family activities are taken into account.

Also Read: Tips For Choosing Quality Supplements At Your Nearest Vitamin Store

Consider Premiums and Financial Feasibility

Premiums are a key factor in choosing private health insurance. Choose a premium that fits your family’s budget to ensure consistent payments without burdening your monthly finances. Don’t just choose the lowest premium; also consider the benefits received. A cheap policy with limited coverage can pose a high risk in the event of a serious medical condition.

Furthermore, consider the premium payment system, whether it’s annual, semi-annual, or monthly, and consider your long-term financial capabilities. Premium increases should also be considered, especially if the policy has provisions for annual adjustments based on age or health inflation.

Check the Insurance Company’s Reputation and Claims Service

The quality of an insurance company’s service is just as important as the policy’s benefits. Choose a company with a good reputation for claims processing, customer service, and hospital network. Customer reviews and testimonials can be a starting point for understanding real-life user experiences.

Also, check the ease of claims, whether the company offers cashless or reimbursement services, and the claims resolution time. A responsive and transparent company will make your family’s experience more comfortable and secure.

Understand Your Family’s Health Needs

Before choosing private health insurance, it’s crucial to understand the health needs of all family members. Each member has different needs, such as children who require comprehensive vaccinations and inpatient care, or adults who may require regular checkups and chronic disease coverage. Understanding your family’s medical history, including allergies, pre-existing conditions, or specific health conditions, will help determine the most appropriate policy type. Thank you for taking the time to explore this interesting information about choosing private health insurance for your family at The Health Universe, We’ll provide you with much more information soon.

Image Information Source:

First Image: floridaallrisk.com

Second Image: slideteam.net