For the improved element of a ten years, a time bomb has been ticking at Oakland-dependent Kaiser Permanente — an accumulation of allegations that the large wellness system systematically defrauded Medicare by overstating the severity of its patients’ clinical circumstances.

On July 30, the bomb detonated. Which is when the Division of Justice joined six lawsuits filed by Kaiser employees because 2013 asserting that they witnessed the alleged fraud.

The government’s motion right away introduced those lawsuits, which experienced been submitted less than seal in federal courtroom in San Francisco, into the daylight. Taken alongside one another they allege wrongdoing on a beautiful scale plaintiffs’ lawyers included in the conditions say hundreds of hundreds of thousands of dollars in penalties and harm claims may perhaps be at stake.

Medicare Gain corporations…have some incentive to improperly inflate their enrollees’ capitation fees, if these organizations tumble prey to greed.

U.S. Magistrate Laurel Beeler

At this stage, none of the allegations has been proved in court. Kaiser denies them, stating that it has been compliant with the policies governing Medicare statements and intends to “strongly defend towards the lawsuits alleging usually.” It says it’s “disappointed the Section of Justice would go after this path.”

But the allegations, and the Section of Justice’s decision to support them by getting to be a co-plaintiff towards Kaiser, level to a greater concern with Medicare — particularly, the Medicare Edge method, which permits private well being insurers alternatively than government directors to give protection to seniors. The indications are that Medicare Gain is profoundly contaminated with fraud.

E-newsletter

Get the latest from Michael Hiltzik

Commentary on economics and a lot more from a Pulitzer Prize winner.

You may perhaps often acquire promotional articles from the Los Angeles Times.

Recently, the federal authorities has joined in personal lawsuits towards a host of big healthcare companies and wellbeing insurers.

“It’s sector-extensive and it is of significant proportions,” states Mary Inman of Constantine Cannon, a regulation organization specializing in whistleblower conditions, which quantities 1 of the Kaiser whistleblowers amongst its purchasers.

Inman suggests just about every main wellbeing insurance policy corporation has faced these allegations a cottage sector has sprung up of companies purporting to assistance Medicare companies make “accurate” filings with the federal government but, in simple fact, exhibiting them how to game authorities regulations. “It’s not heading away any time quickly,” she claims.

In current years, the govt has extracted settlements from several healthcare companies accused of exaggerating individual situations to inflate Medicare Edge fees, which are centered partially on “risk scores,” assessments of the health of particular person enrollees.

The resolutions incorporated a $270-million settlement in October 2018 from El Segundo-dependent Health care Companions and a $30-million settlement in April 2019 from Sacramento-based Sutter Health. The providers settled devoid of admitting to the allegations.

A key situation brought versus UnitedHealth Team, the nation’s most significant health insurer by membership, is pending in Los Angeles federal courtroom, with a trial day not scheduled until 2023. The DOJ filed a case very last year in opposition to Anthem, the second-major insurance provider, in Manhattan federal court docket. A settlement in a further scenario against Sutter Overall health is envisioned to be introduced imminently. UnitedHealth, Anthem and Sutter did not answer to requests for comment.

The Benefit plan isn’t the only generator of fraud issues in Medicare. In 2018, for instance, Ontario-primarily based Key Healthcare compensated $65 million to settle charges of overbilling Medicare. The healthcare facility community did not acknowledge to the allegations.

Medicare Gain was created in element to counteract a structural flaw in Medicare — since the plan paid medical professionals a charge for each support they rendered, it carried a designed-in incentive for doctors to do a lot more than their patients necessary, merely to jack up their billings.

Less than Medicare Advantage, wellbeing designs are compensated a established volume per affected individual for each month, acknowledged as a capitation. If the physicians overprescribe, they could reduce revenue on individual treatment if they preserve services under manage, they pocket a lot more of the capitation for by themselves.

The stakes in the fraud scenarios are huge. Medicare Benefit danger changes ordinary $3,000 per calendar year for every documented condition. That can double the capitation rates for enrollees with various challenges. In 2013 on your own, in accordance to an audit by the Governing administration Accountability Business, Medicare overpaid Medicare Advantage companies $14.1 billion, primarily since of “unsupported diagnoses.”

“Unfortunately, human nature getting what it is,” U.S. Justice of the peace Laurel Beeler noticed last calendar year in rejecting Sutter Health’s movement to dismiss the circumstance towards it, “Medicare Advantage businesses … have some incentive to improperly inflate their enrollees’ capitation premiums, if these companies slide prey to greed.”

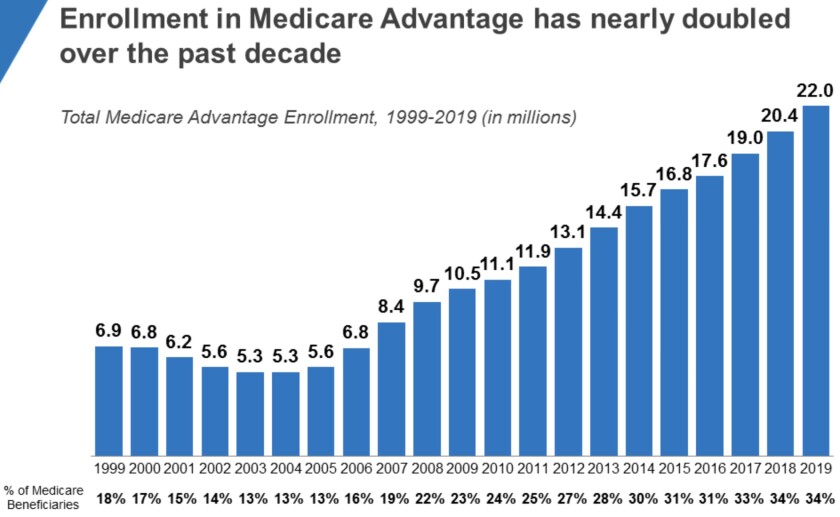

Medicare Advantage enrollment has soared in current several years, allegedly opening the door to substantial fraud.

(Kaiser Spouse and children Foundation)

The Kaiser allegations may possibly be the most explosive mainly because of its one of a kind place in American health care.

“They’re the mother of managed care,” Inman says. “There’s something truly substantial about them becoming engaged in this apply. They’re witnessed as a chief, and for them to stoop to doing this exhibits how irresistible the notion is of increasing your hazard rating to enhance your reimbursement from Medicare.”

She may have additional that the allegations, if real, are significantly deplorable provided that Kaiser is a nonprofit organization.

Various aspects could account for the clear explosion in fraud allegations in Medicare. 1 is the federal Wrong Promises Act, which Congress upgraded in 1986 to make certain whistleblowers of a sizable share of recoveries from cheating government contractors — up to about 25% in cases in which the government participated as a plaintiff, and 30% if they pursued claims on their individual.

That inspired a surge in “qui-tam” lawsuits — the phrase will come from the Latin for “in the title of the king” — by whistleblowers.

One more is the maturity of the Medicare Benefit method, which was established in the 1970s to make it possible for seniors to acquire Medicare providers by way of personal health and fitness insurers relatively than the traditional federal government-administered plan.

Personal overall health ideas appreciate Medicare Gain. It attracts a commonly much healthier consumer base than classic Medicare, so significantly so that critics have continuously maintained that capitations exceed what is necessary to provide enrollees and give wellbeing strategies with a sensible financial gain.

The health plans can obtain enhanced capitations for unique individuals by demonstrating that they are victims of distinct illnesses that are primarily high-priced to handle, these types of as diabetes, stroke or pulmonary complications, a system regarded as chance-adjustment.

The wellbeing programs have strived to appeal to far more enrollees — and healthier types — by featuring these kinds of ancillary companies as health club memberships and vision and dental care, some of which can be received only by enrolling in “Medigap” plans that cover products and services unavailable by means of conventional Medicare. Medicare Advantage enrollment has been increasing sharply in the latest decades, achieving 22 million, or 34% of all Medicare enrollment, in 2019.

It really should be crystal clear that health options have two main approaches to improve their Medicare Gain income — by slicing costs, or rising danger-adjustment payments.

To control the latter, Medicare imposes constraints on danger-adjustment statements: They simply cannot final result basically from radiology or laboratory assessments but ought to replicate face-to-encounter encounters between health care provider and patient that outcome in treatment, and those people encounters have to be comprehensively documented.

An evaluation of the various wrong promises lawsuits at this time submitted in opposition to main health care suppliers indicates that the field has been really imaginative at circumventing these principles.

In a evaluate of the threat-adjustment landscape for an business conference in 2012, Inman claimed that the dodges ranged from basically earning up diagnoses and remedies, to exaggerating the severity of a patient’s problem, to claiming that a client was staying currently dealt with for a condition such as stroke or most cancers that had essentially been handled in the previous.

“You could have a client with minimal melancholy who’s out of the blue upcoded to significant depression,” Inman advised me. “You see prevalence prices for some circumstances that are not dependable with what you would anticipate to see in the standard population. We were looking at cases of malnutrition that you weren’t expecting to see wherever outside sub-Saharan Africa.”

Until finally not long ago, authorities auditors could be relied on to be asleep at the switch, in part mainly because they have been outgunned by health care vendors. That may possibly have encouraged far more gaming of the program. The spate of new cases may show that they are waking up.

These instances normally aren’t resolved promptly or easily. They begin with the filing of a qui-tam lawsuit less than seal, with the hope of persuading the authorities to execute its very own investigation major to its intervention as a co-plaintiff with the whistleblower. Those investigations can acquire a long time, all through which the specific plaintiffs’ conditions are put in abeyance so as not to interfere with the governing administration probes.

That delivers us back again to the allegations versus Kaiser, which have been disclosed as a end result of the government’s intervention.

In a situation filed in 2013, info high quality employee Ronda Osinek states that about 2007, Kaiser begun “diagnosis chasing” — poring around client facts for conditions these as diabetes, kidney illness and depression that would warrant proclaiming larger-possibility reimbursements.

Some of these inquiries demanded doctors to amend their affected individual data files, from time to time months immediately after the individual visits, she states. Kaiser even appeared to recommend the language to use so that quite a few bore opinions these as, “After reviewing the notes from the aforementioned visit, I recall the take a look at,” accompanied with a revised diagnoses and treatment. Kaiser held “mandatory … ‘coding parties’” at which medical doctors ended up collected in a place with computer systems and instructed to glimpse for feasible revisions in their individual notes.

In a situation filed in 2014, James M. Taylor, then a Kaiser health practitioner with an know-how in healthcare coding, alleged that Kaiser disregarded his efforts to proper systematic faults in its submissions to Medicare. Taylor also asserted that Kaiser was considerably extra diligent in ferreting out coding mistakes that had led to reduced reimbursements than errors that had developed overpayments — and that it failed to report some overpayments that it was needed to return to the govt.

Taken at experience value, the allegations in opposition to Medicare Edge companies imply a stupendous misdirection of government assets into the improper fingers. The GAO believed in 2014 that just about 10% of the payments to Medicare Gain businesses were being poor. Supplied that Medicare Gain suppliers had been compensated about $290 billion last yr, that implies some $30 billion a calendar year might be going astray.

Which is revenue that could be employed for a host of goals other than fattening the budgets of health care organizations: funding universal coverage, reinvigorating the nation’s tattered general public wellbeing infrastructure, you title it. The gain motive has long been a huge drag on the American healthcare program, but it’s much worse when the gains are dishonestly received.