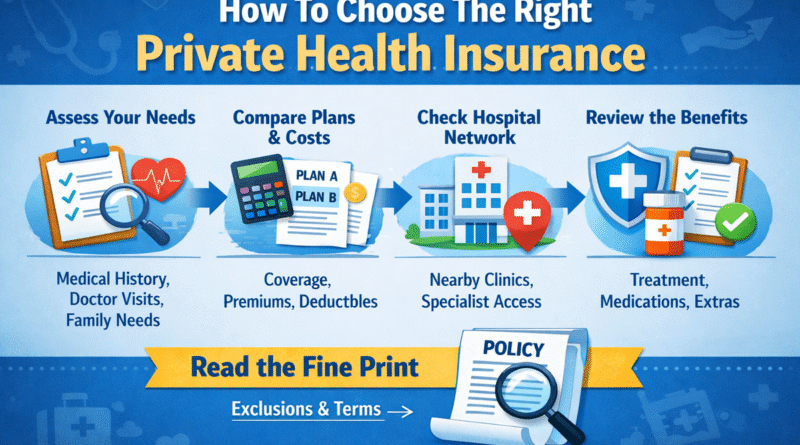

How To Choose The Right Private Health Insurance

Learn how to choose the best private health insurance plan with tips on coverage, costs, providers, and extra benefits.

With numerous providers, coverage options, and premium structures, it’s easy to feel overwhelmed. However, understanding your personal healthcare needs, evaluating plan features, and comparing costs can make the process much simpler.

The following The Health Universe will walk you through essential factors to consider when selecting a private health insurance plan, ensuring you make an informed decision that aligns with your health and financial goals.

Understanding Your Healthcare Needs

Before exploring available plans, it’s crucial to evaluate your personal healthcare requirements. Consider your current health status, any chronic conditions, and anticipated medical needs. Understanding these factors helps you identify the types of coverage you truly need, such as specialist visits, hospitalization, or prescription medications.

Additionally, think about your family situation. If you have dependents, you’ll need a plan that accommodates their healthcare needs. Assessing your risk factors and potential medical expenses in advance allows you to focus on plans that offer meaningful coverage, avoiding unnecessary costs for services you may never use.

Comparing Coverage Options

Private health insurance plans vary widely in terms of coverage. Some plans may include comprehensive hospital care, specialist consultations, preventive services, and dental or vision care, while others may focus on essential coverage only.

Pay attention to limits, exclusions, and waiting periods for specific treatments. Certain plans may have restrictions on pre-existing conditions or specialized treatments. By carefully comparing coverage details, you can ensure the plan you choose meets your health needs without leaving significant gaps in protection.

Read Also: Tips For Choosing Quality Supplements At Your Nearest Vitamin Store

Evaluating Premiums and Out-of-Pocket Costs

Premiums are the regular payments you make for your insurance plan, but they are only part of the cost equation. Out-of-pocket expenses, including deductibles, co-payments, and coinsurance, can significantly impact your total healthcare spending.

When assessing a plan, calculate both monthly premiums and potential out-of-pocket costs. A lower premium may seem attractive but could result in higher expenses when accessing care. Balancing premium affordability with reasonable coverage and manageable out-of-pocket costs is essential for long-term financial sustainability.

Assessing Provider Networks And Accessibility

Private health insurance plans often limit coverage to specific hospitals, clinics, or healthcare professionals. Ensure that your preferred doctors, specialists, and hospitals are included in the plan’s network to avoid unexpected costs.

Consider also the plan’s accessibility and convenience. Check for nearby healthcare facilities, availability of urgent care, and telehealth options. A plan with a broad and accessible provider network ensures that you can receive timely care without facing long delays or travel inconveniences.

Understanding Additional Benefits

Beyond basic medical coverage, many private health insurance plans offer additional benefits such as mental health support, wellness programs, or coverage for alternative therapies. These perks can enhance your overall healthcare experience and may even promote preventive care.

Take time to review optional add-ons and supplemental coverage. Some plans may include maternity benefits, chronic disease management, or international coverage for travel. Evaluating these extras can help you select a plan that provides comprehensive protection tailored to your lifestyle.

Seeking Expert Advice And Reading Reviews

Navigating the complexities of private health insurance can be challenging, so seeking professional guidance can be invaluable. Insurance brokers or financial advisors can provide insights into plan features, hidden costs, and regulatory considerations.

Additionally, reading reviews and testimonials from current or past policyholders offers practical insights. Real-world experiences reveal how effectively claims are processed, customer service quality, and overall satisfaction.

Conclusion

Choosing the best private health insurance plan requires careful consideration of your healthcare needs, coverage options, costs, provider accessibility, and additional benefits. Evaluating these factors systematically, seeking expert guidance, and learning from others’ experiences ensures that you select a plan that balances protection, convenience, and affordability.

By taking a thoughtful, informed approach, you can secure a private health insurance plan that meets your medical needs and provides peace of mind for the future. Don’t miss out! Keep following for the latest exclusive updates available only here The Health Universe.

Image Source From.

- First Photo From: The Health Universe

- Second Photo of: www.dnsstuff.com