Private Health Insurance Investing in Your Healthy Future

Private Health Insurance helps protect your health, provides the best access, and is a smart investment for your family’s healthy future.

Private Health Insurance provides comprehensive coverage, ensuring access to quality medical care without delay. Below The Health Universe will discuss the importance of this insurance for your health future.

Why Private Health Protection is Important in the Modern Era

Evolving lifestyles and rising healthcare costs require everyone to seriously consider health protection. Many illnesses appear without warning, while the cost of medical examinations and procedures can quickly drain your savings.

Private health insurance plays a crucial role. With this coverage, individuals can gain faster access to treatment, a wider choice of hospitals, and a variety of additional facilities that enhance the quality of care. The availability of comfortable treatment rooms, specialist doctors, and responsive service make health protection not just a necessity, but part of long-term life planning.

Furthermore, having private coverage gives you peace of mind in your daily routine. In the event of an emergency, you won’t have to worry about costs or the availability of services.

Investing in Health for a Better Quality of Life

Health is a valuable asset that cannot be replaced. Investing in insurance provides significant long-term benefits. Premiums are not just an expense, but a contribution to future financial security.

Some companies offer additional benefits such as regular checkups, disease prevention programs, and free consultations. This service helps maintain your health before problems arise. This investment works both ways: protecting you when you’re sick and maintaining stable health when you’re fit.

Another benefit is cost certainty. Many people feel burdened by large bills, but with the right protection, this risk can be minimized. Investing in health insurance also allows you to plan your family’s finances wisely.

Tips for Choosing the Right and Most Profitable Health Insurance

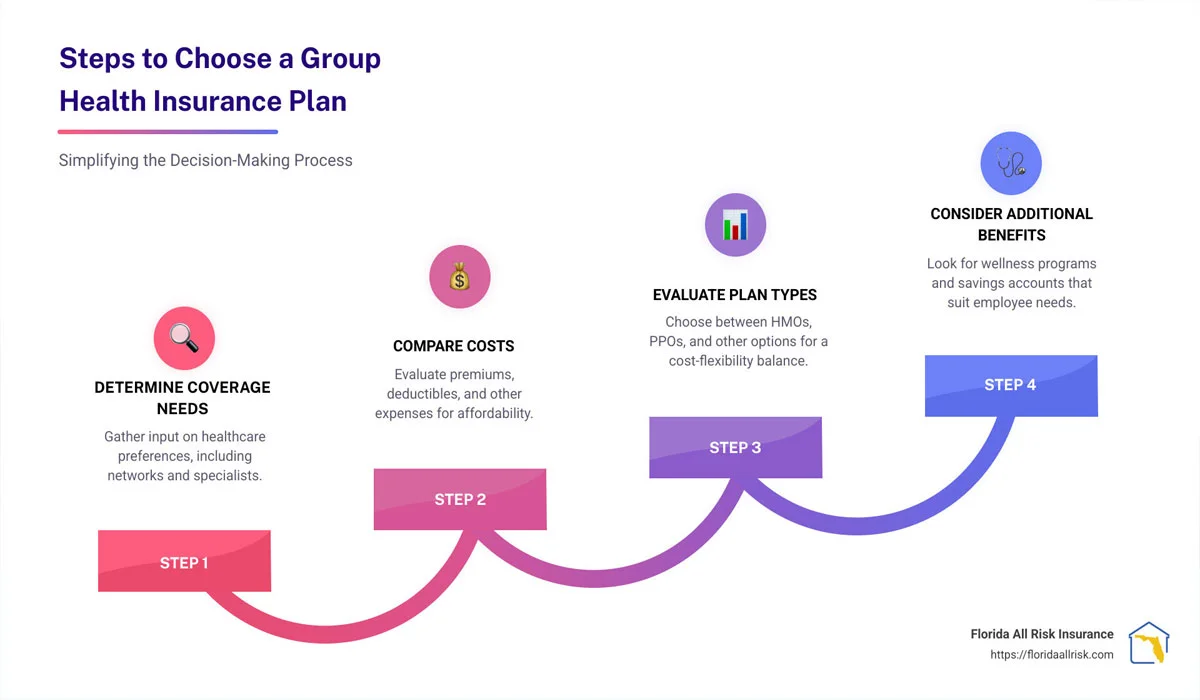

Choosing the right health insurance isn’t something to take lightly. The first step is to understand your personal and family needs, such as your medical history, age, and desired service priorities After that, examine the benefits offered. The best choice is coverage that covers outpatient care, inpatient care, major procedures, and specialist consultations. Also, ensure a wide hospital network so you have multiple options when you need treatment.

In addition to coverage, consider the ease of the claims process. A good policy should have a fast, transparent, and easy claims system. Also, pay attention to the insurance company’s reputation and user reviews to avoid disappointment later.

By considering all these aspects, you can find the private health insurance that best suits your needs and financial capabilities.

How to Maximize Your Health Insurance Benefits

Many people have a policy but don’t utilize it optimally. However, many additional benefits can help maintain daily health. Regular checkups, vaccinations, consultations, and even healthy lifestyle programs can all be utilized to improve long-term health.

Understanding the policy is also crucial. Every benefit, limitation, and claim provision must be understood to avoid mistakes when applying for services. With a good understanding, you can take advantage of all benefits without violating the applicable provisions.

Optimizing health insurance isn’t just about getting sick, but also about when your body is still in top condition. With an active approach, this insurance truly serves as an investment for the future, not just a document that is stored unused. Thank you for reading the information about Private Health Insurance and feel free to come back again by clicking this link The Health Universe.